NO.PZ2018111302000053

问题如下:

An buyout PE fund plans to invest in Company B’s all preference shares and 70% of the common equity. Company B’s current valuation is $10 million, consisting of $6.5 million in debt, $2.8 million in preference shares and $0.7 million in common equity. The expected exit value in five years is $15 million, with an estimated reduction in debt of $2.5 million and 15% annual return on preference shares. The multiple of expected proceeds at exit to invested funds is closest to:

选项:

A.2.73x.

B.2.85x.

C.2.96x.

解释:

B is correct.

考点:PE退出倍数计算

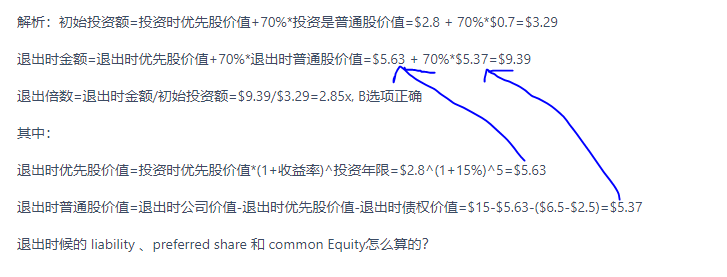

解析:初始投资额=投资时优先股价值+70%*投资是普通股价值=$2.8 + 70%*$0.7=$3.29

退出时金额=退出时优先股价值+70%*退出时普通股价值=$5.63 + 70%*$5.37=$9.39

退出倍数=退出时金额/初始投资额=$9.39/$3.29=2.85x, B选项正确

其中:

退出时优先股价值=投资时优先股价值*(1+收益率)^投资年限=$2.8^(1+15%)^5=$5.63

退出时普通股价值=退出时公司价值-退出时优先股价值-退出时债权价值=$15-$5.63-($6.5-$2.5)=$5.37

退出时候的 liability 、preferred share 和 common Equity怎么算的?