NO.PZ2018122701000049

问题如下:

A portfolio consists of options on Microsoft and AT&T. The options on Microsoft have a delta of 1000, and the options on AT&T have a delta of 20000. The Microsoft share price is $120, and the AT&T share price is $30. Assuming that the daily volatility of Microsoft is 2% and the daily volatility of AT&T is 1% and the correlation between the daily changes is 0.3, the 5-day 95% VaR is

选项:

A.26193

B.25193

C.27193

D.24193

解释:

A is correct.

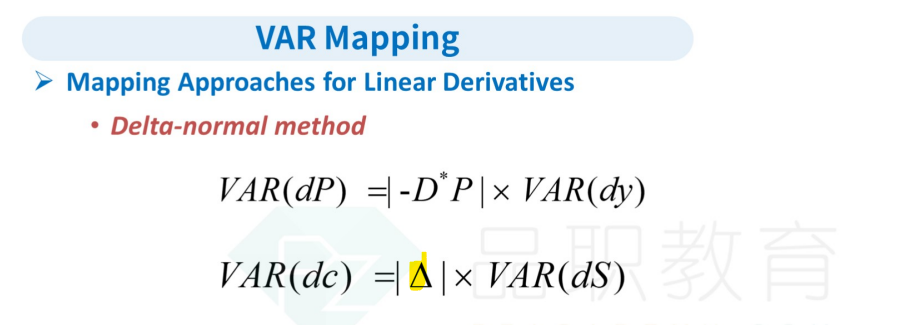

考点:Mapping to Option Position

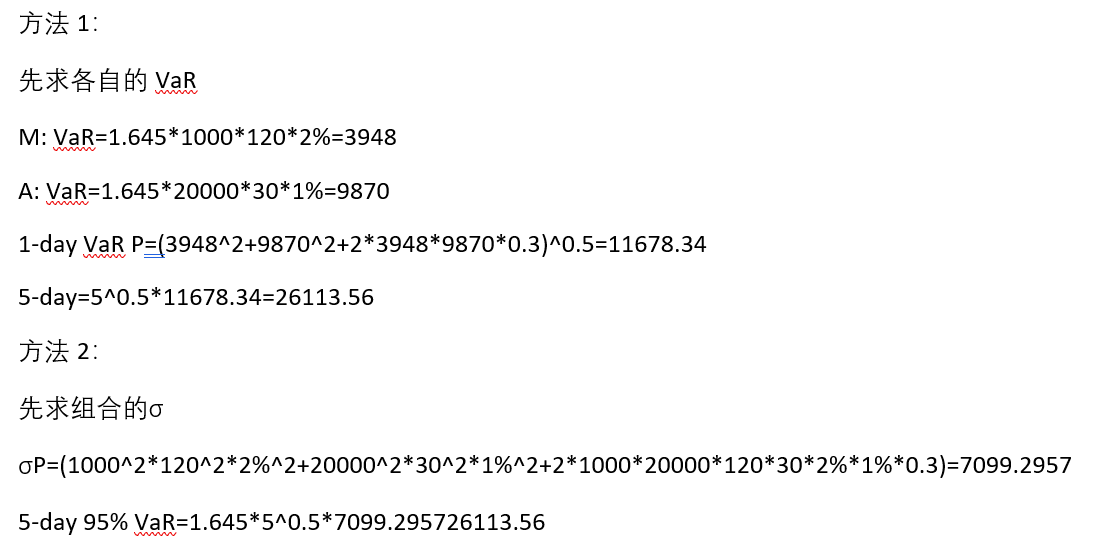

解析:VaRMic= 1.65 × 2% × 120 × 1000 = 3960

VaRAT&T= 1.65 × 1% × 30 × 20000=9900

老师您好,

我能明白题目的解法。但是在做的时候,我突然想尝试用miu ≠ 0 的那种带权重的方式求解。这里的权重应该怎么计算呢。麻烦老师解答。我的直觉是用金额直接放进去算,但是好像又不太对