NO.PZ2020033003000102

问题如下:

In merton model, which of the following statement about the valuation of senior and subordinated debt is correct? Assume the firm is in a poor financial condition.

选项:

A.Both the senior debt and subordinated debt's valuation increase as the debt maturity, firm volatility, or interest rates increase.

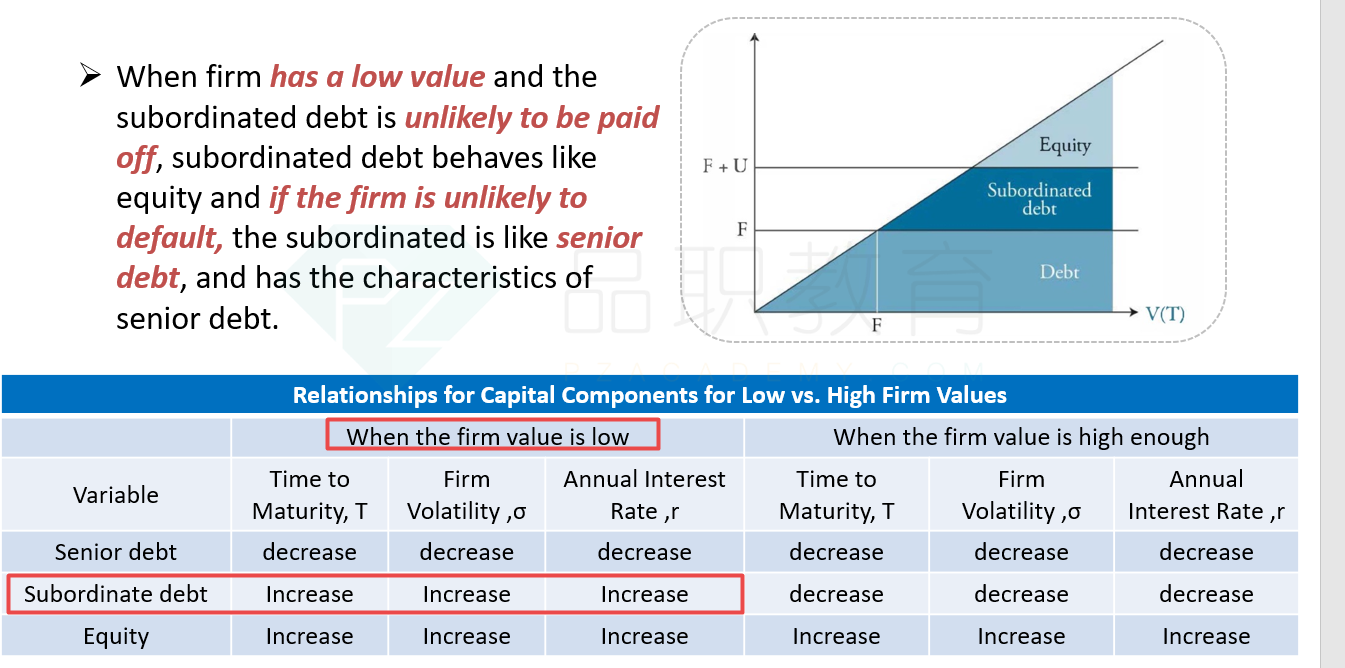

B.The debt maturity, firm volatility and interest rates have opposite effects on the valuations of senior debt and subordinated debt. The valuation of the subordinated debt increases as the factor mentioned above increase, while the senior debt decreases under the same condition.

C.The debt maturity, firm volatility and interest rates have opposite effects on the valuations of senior debt and subordinated debt. The valuation of the senior debt increases as the factor mentioned above increase, while the subordinated debt decreases under the same condition.

D.Both the senior debt and subordinated debt's valuation increase as the debt maturity, firm volatility, or interest rates decrease.

解释:

B is correct.

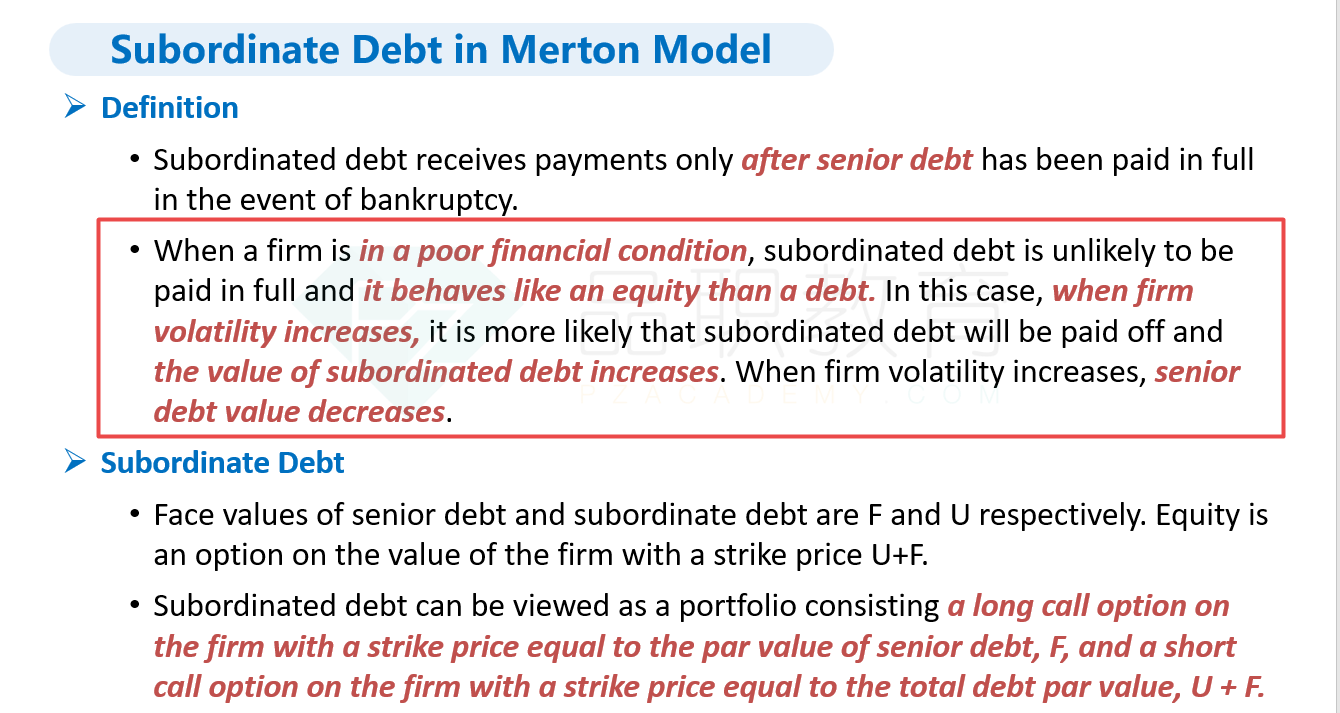

考点:Subordinate Debt in Merton Model

解析:当公司的财务状况不好时,subordinated debt 表现得更像equity。

经济好的时候subordinate bond 和senior bond都是随着 到期日增加,公司的价值波动性增加,利率的上升,债券价值下降吧?