NO.PZ2016082402000052

问题如下:

Suppose that the yield curve is upward sloping. Which of the following statements is true?

选项:

A.The forward rate yield curve is above the zero-coupon yield curve, which is above the coupon-bearing bond yield curve.

B.The forward rate yield curve is above the coupon-bearing bond yield curve, which is above the zero-coupon yield curve.

C.The coupon-bearing bond yield curve is above the zero-coupon yield curve, which is above the forward rate yield curve.

D.The coupon-bearing bond yield curve is above the forward rate yield curve, which is above the zero-coupon yield curve.

解释:

ANSWER: A

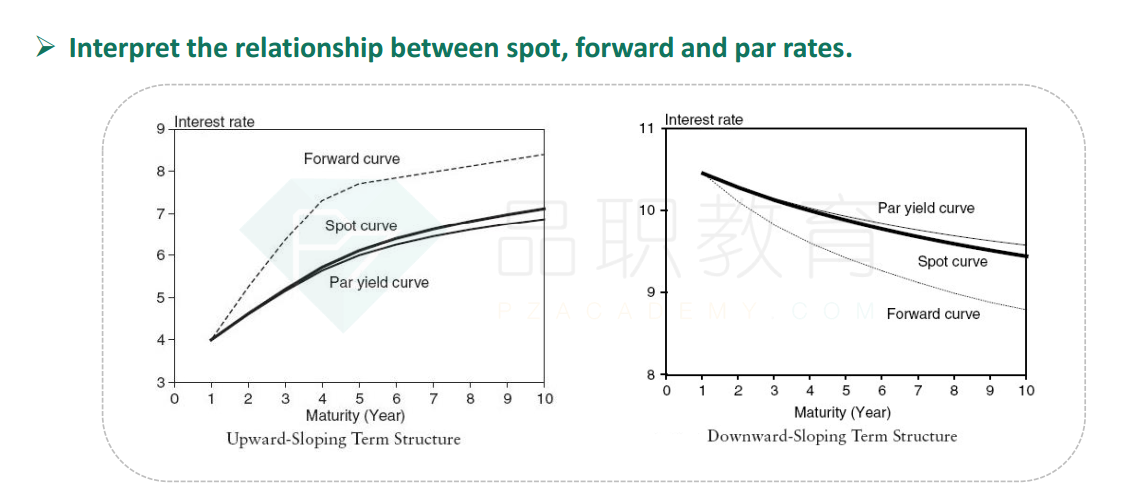

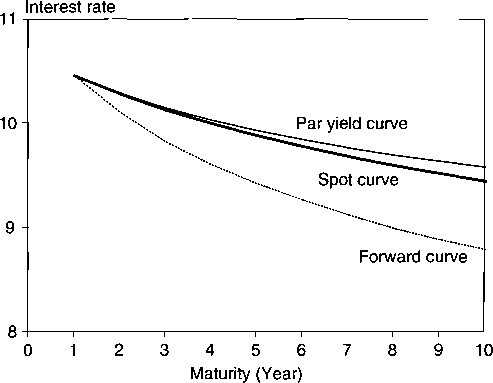

See Figures below:

The coupon yield curve is an average of the spot, zero-coupon curve; hence it has to lie below the spot curve when it is upward sloping. The forward curve can be interpreted as the spot curve plus the slope of the spot curve. If the latter is upward sloping, the forward curve has to be above the spot curve.

解析:

假设利率曲线是向上倾斜的,下面那一个说法是正确的?

利率曲线向上倾斜的时候,forward rate高于spot rate高于 par yield。

利率曲线向下倾斜的时候,par yield高于spot rate高于forward rate。

所以A正确。

1,zero-coupon yield就是spot rate?

2.coupon-bearing bond yield就是par rate吗?为什么?par rate 只是一种特殊的coupon-bearing bond yield吧,讲义里的三条yield curve中一条是par rate呀,为什么这道题里用一般的coupon-bearing bond yield代替par rate呢?

谢谢。