NO.PZ2018062006000132

问题如下:

An annual coupon bond is priced at par value, the coupon rate is 5%, and there are 10 years to its maturity from now. Suppose the investment horizon is 5 years and the approximate modified duration of the bond is 6.872. At the time of purchase, the duration gap should be:

选项:

A.

-2.22

B.

1.87

C.

2.22

解释:

C is correct.

As the bond is priced at its par value, the YTM equals to its coupon rate, which is 5%.

The approximate Macaulay duration = the approximate modified duration × (1+ yield-to-maturity) = 6.872× 1.05 = 7.2156

Duration gap = Macaulay duration - investment horizon = 7.2156-5 = 2.2156

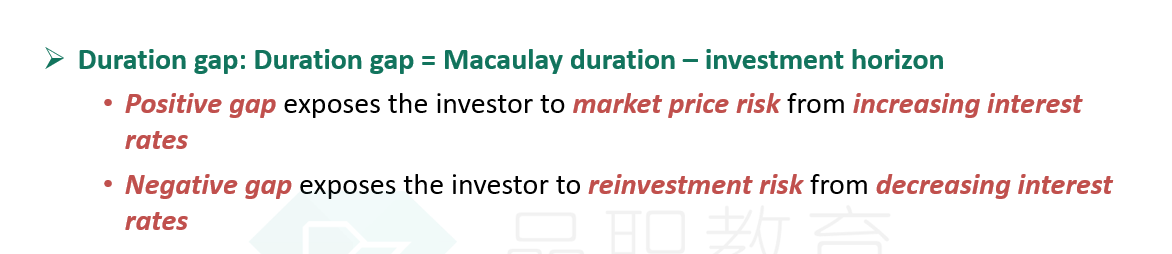

考点:duration gap

解析:duration gap = Macaculay duration - investment horizon = Modified duration × (1+y) - investment horizon = 6.872 × 1.05 - 5 = 2.2156,故选项C正确。

我怎么对Duration gap 没有印象呢