NO.PZ202210140200000102

问题如下:

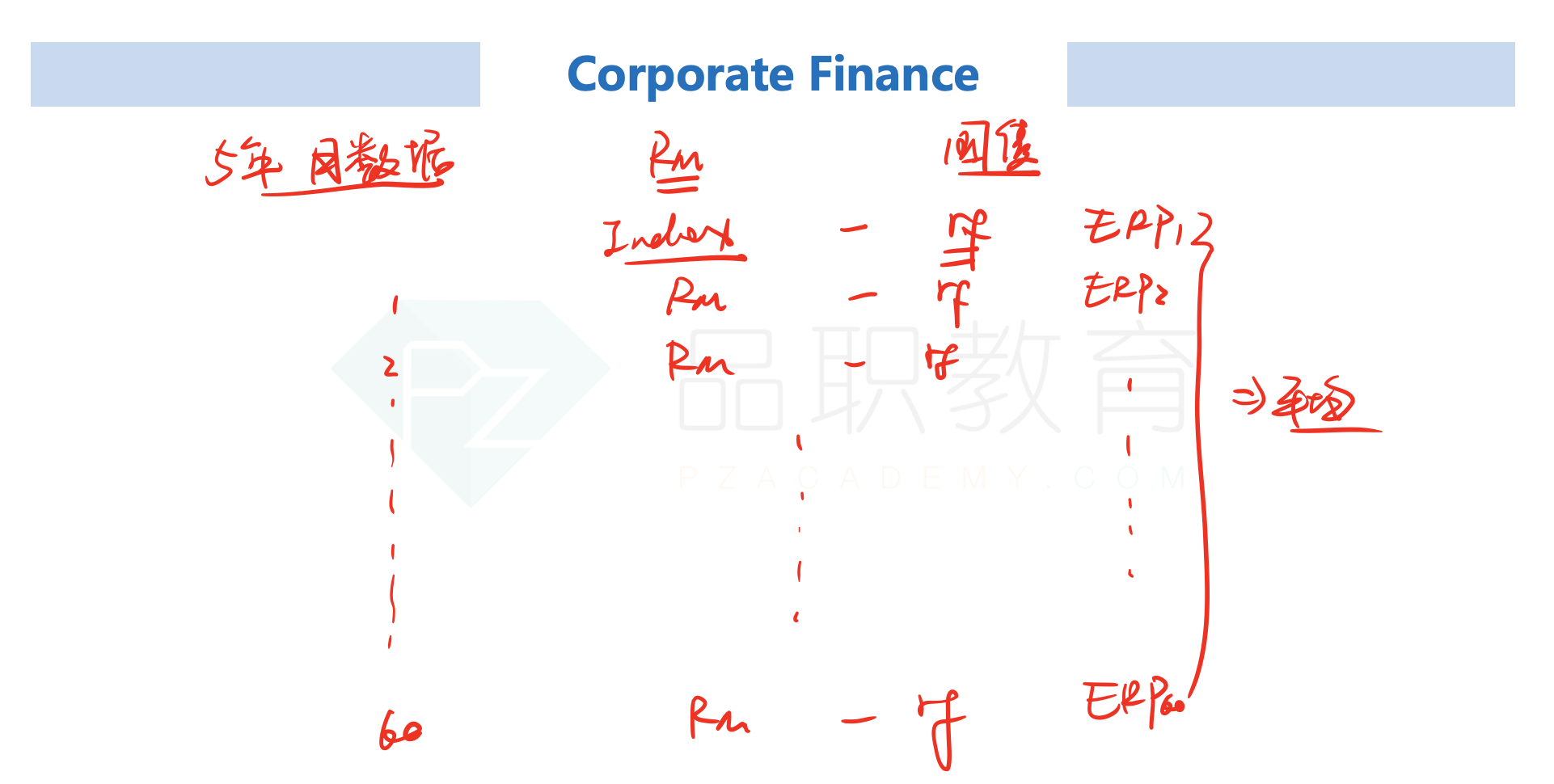

The events of 2012 to 2016 would be expected to:

选项:

A.

bias the historical ERP estimate upward

B.

bias the historical ERP estimate downward

C.

have no effect on the historical ERP estimate

解释:

B is correct. The events of Year 12 through Year 16 depressed share returns but (1) are not a persistent feature of the stock market environment, (2) were not offset by other positive events within the historical record, and (3) have led to relatively low valuation levels, which are expected to rebound.

这道题没看懂,能解释下吗?