NO.PZ201712110100000208

问题如下:

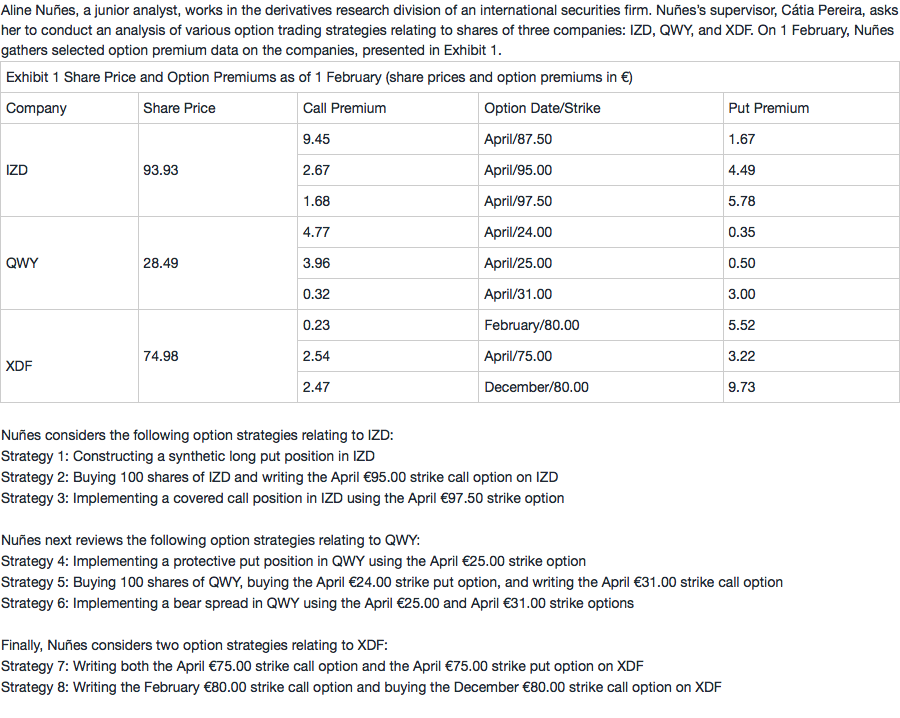

Aline Nuñes, a junior analyst, works in the derivatives research division of an international securities firm. Nuñes’s supervisor, Cátia Pereira, asks her to conduct an analysis of various option trading strategies relating to shares of three companies: IZD, QWY, and XDF. On 1 February, Nuñes gathers selected option premium data on the companies, presented in Exhibit 1.

Nuñes considers the following option strategies relating to IZD:

Strategy 1: Constructing a synthetic long put position in IZD

Strategy 2: Buying 100 shares of IZD and writing the April €95.00 strike call option on IZD

Strategy 3: Implementing a covered call position in IZD using the April €97.50 strike option

Nuñes next reviews the following option strategies relating to QWY:

Strategy 4: Implementing a protective put position in QWY using the April €25.00 strike option

Strategy 5: Buying 100 shares of QWY, buying the April €24.00 strike put option, and writing the April €31.00 strike call option

Strategy 6: Implementing a bear spread in QWY using the April €25.00 and April €31.00 strike options

Finally, Nuñes considers two option strategies relating to XDF:

Strategy 7: Writing both the April €75.00 strike call option and the April €75.00 strike put option on XDF

Strategy 8: Writing the February €80.00 strike call option and buying the December €80.00 strike call option on XDF

Based on Exhibit 1, the maximum gain per share that could be earned if Strategy 7 is implemented is:

选项:

A.

€5.74.

B.

€5.76.

C.

unlimited.

解释:

B is correct.

Strategy 7 describes a short straddle, which is a combination of a short put option and a short call option, both with the same strike price. The maximum gain is €5.76 per share, which represents the sum of the two option premiums, or c0 + p0 = €2.54 + €3.22 = €5.76. The maximum gain per share is realized if both options expire worthless, which would happen if the share price of XDF at expiration is €75.00.

中文解析:

策略7描述了一种short straddle策略,它是由short call和short put构成的,call和put具有相同的执行价格。

最大收益发生在股价等于两个期权的执行价格75的时候,此时收益最大为卖掉两个期权获得的期权费= €2.54 +€3.22 =€5.76。

这个题我有点晕了,每次做完5.76,又看了下现在的股价,认为客户会立马行权。。。能再帮我理一下期权的过程吗?是不是说在某一段时间内,比如七月,客户才可以行权,那时如果股价横在执行价格,客户也不会行权,就可以赚满两个期权费了?