NO.PZ201511190100001101

问题如下:

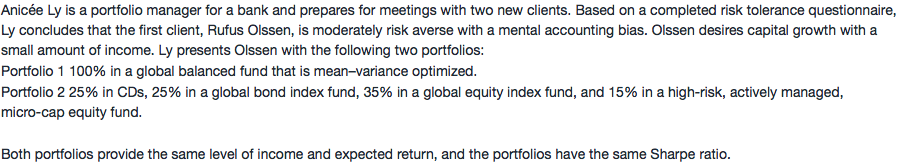

Determine, assuming Ly’s bias conclusion is correct, which portfolio Olssen would most likely select.(circle one)

Portfolio 1

Portfolio 2

Justify your response.

选项:

解释:

Olssen would most likely select Portfolio 2.

●A mental accounting bias suggests that Olssen might consider his investments in layers.

●Portfolio 2 has the same income, expected return, and Sharpe ratio as Portfolio 1 and is structured in layers.

The results of the risk tolerance questionnaire suggest that Olssen exhibits a mental accounting bias. He likely compartmentalizes his portfolio into discrete layers of low-risk assets versus risky assets without regard to the correlations among the assets. Portfolio 2 is constructed in this way, with discrete layers for each objective, while Portfolio 1 is constructed to be mean–variance optimized. As a result, Olssen would most likely select Portfolio 2, particularly because it has the same income, expected return, and Sharpe ratio as Portfolio 1.

The second client, Verochka Calderón, gives Ly a list of the four highest-performing funds in her defined contribution plan and asks Ly to recommend an allocation. After Calderón completes a risk tolerance questionnaire, Ly determines that Calderón likely exhibits framing and regret biases. Using the four funds, Ly suggests two allocations, presented in Exhibit 1.

老师,题目里哪里说了mental accounting bias呢?

我看到的是regret biases, 所以就选择了Portfolio A,因为怕后悔就平均投了。

麻烦帮忙解答一下,谢谢。