NO.PZ2020042003000040

问题如下:

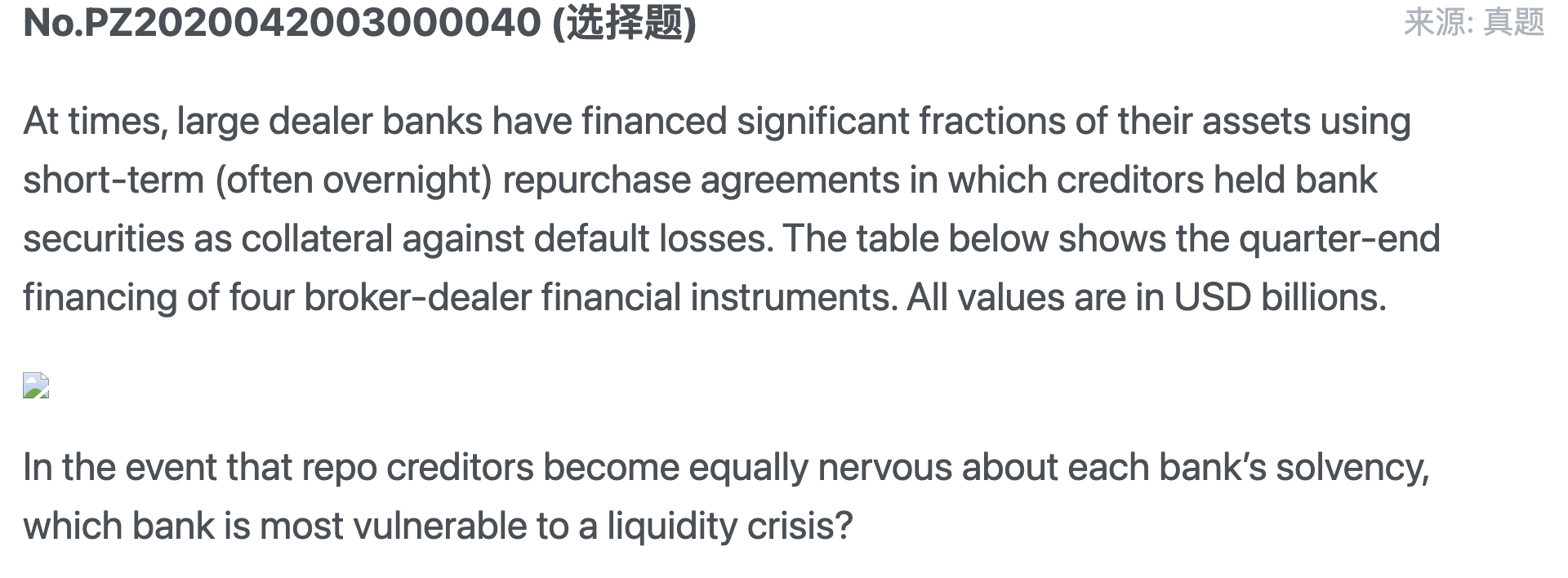

At times, large dealer banks have financed

significant fractions of their assets using short-term (often overnight)

repurchase agreements in which creditors held bank securities as collateral

against default losses. The table below shows the quarter-end financing of four

broker-dealer financial instruments. All values are in USD billions.

In the event that repo creditors become equally nervous about each bank’s solvency, which bank is most vulnerable to a liquidity crisis?

选项:

A. Bank A

Bank B

Bank C

Bank D

解释:

考点:对The Failure Mechanics of Dealer Banks的理解

答案: 选项B正确。

解析:

Not pledged assets在Financial

instruments owned里的占比越高代表在Liquidity crisis时越安全,相反,如果Not pledged assets在Financial instruments

owned里的占比越低,则代表越Vulnerable。因为B银行的占比最低,因此在Liquidity crisis时,他是Most vulnerable。