NO.PZ2016012101000166

问题如下:

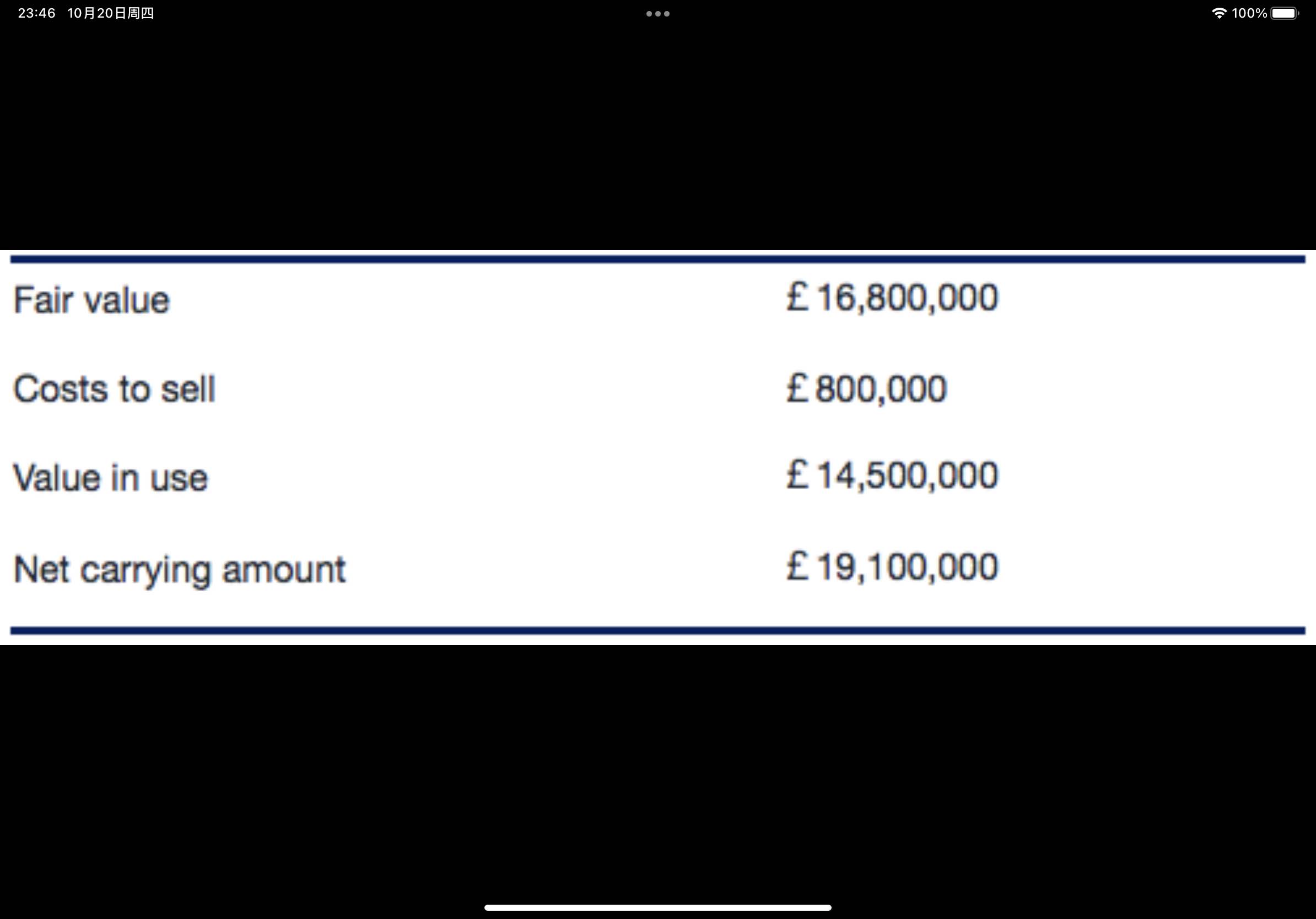

An analyst is studying the impairment of the manufacturing equipment of WLP Corp., a UK-based corporation that follows IFRS. He gathers the following information about the equipment:

The amount of the impairment loss on WLP Corp.’s income statement related to its manufacturing equipment is closest to:

选项:

A.

£2,300,000.

B.

£3,100,000.

C.

£4,600,000.

解释:

B is correct.

Impairment = max(Fair value less costs to sell; Value in use) – Net carrying amount= max(16,800,000–800,000; 14,500,000)–19,100,000 = –3,100,000.

解析:IFRS下计算减值金额。

IFRS下固定资产减值处理方法是“一步法”——用账面净值carrying value和recoverable amount进行比较,如果账面价值高于recoverable amount,则需要减值,减值损失就是账面价值高于recoverable amount的部分。

recoverable amount=max(FV-selling cost; Value in use),即(FV-selling cost)和value in use二者中的较高者。其中Value in use是未来现金流折现的现值。

本题中Value in use已知,为14,500,000,FV-selling cost=16,800,000-800,000=16,000,000,取二者较高者16,000,000为recoverable amount。

账面净值19,100,000高于recoverable amount 16,000,000,因此需要进行减值,减值金额为16,000,000-19,100,000=-3,100,000

我是看value in use价值更大 所以要继续使用 然后我用net carrying amount减去了value in use 为什么不对