NO.PZ2018111303000069

问题如下:

Scenery manufacturer is a CHINA-based company, Scenery has a subsidiary, XZZ, operates in US, XZZ was acquired in 2018 and has never paid a dividend. It records inventory using the FIFO method. RMB is expecting depreciation in the future.

Flexi, CFA, he gathers XZZ’s financial statements and the RMB/US dollar exchange rates in the following table:

If the RMB were chosen as the functional currency for XZZ in 2018, Scenery’s shareholders’ exposure will be:

选项:

A.-5

B.2,145

C.860

解释:

A is correct.

考点:exposure

解析:

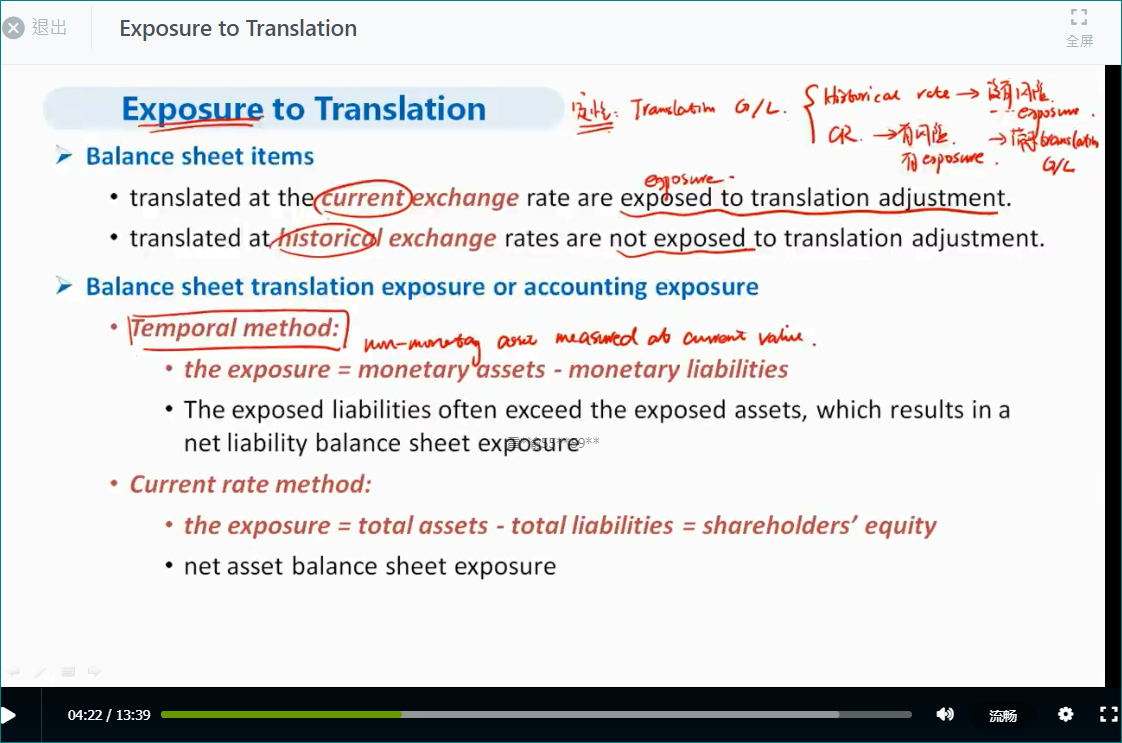

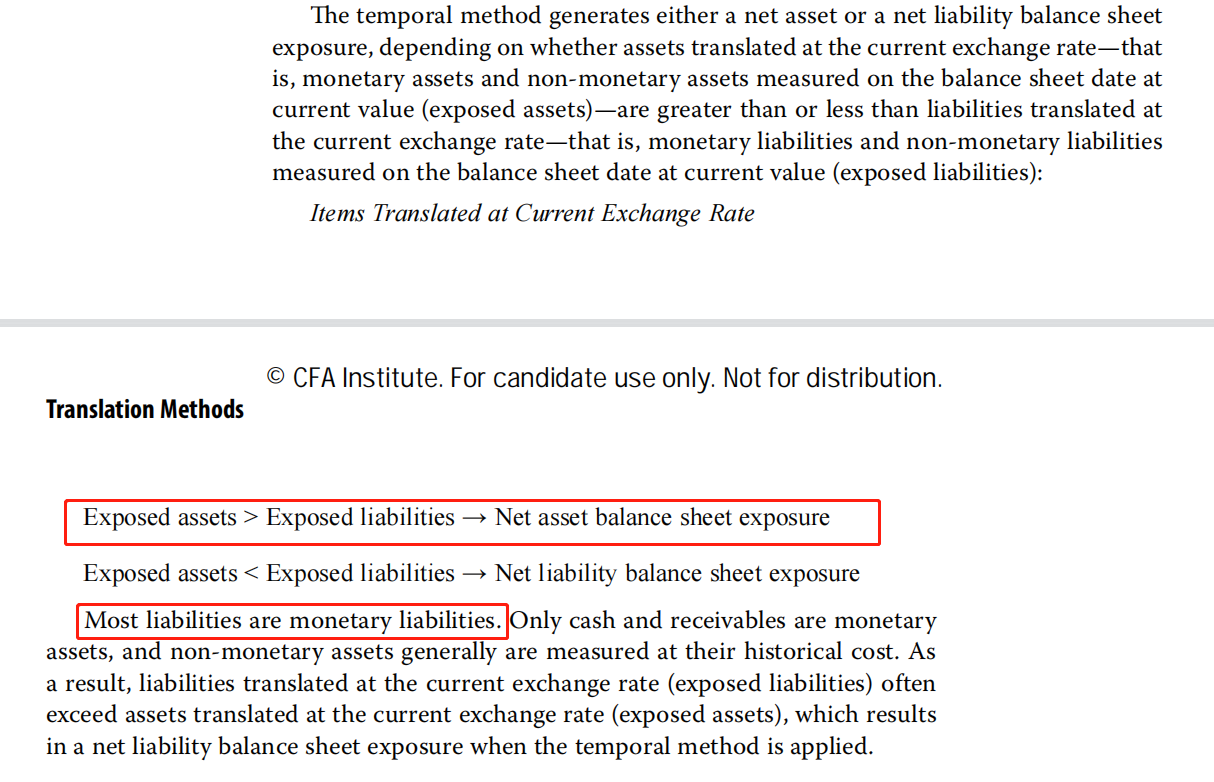

如果RMB是functional currency, 说明functional currency = reporting currency, 我们选择temporal method.

Exposure= monetary assets – monetary liability =210+300-270-245=-5,负号代表exposure为净负债的头寸

问题1

long-term debt长期负债是属於non-monetary liability还是monetary liability? 我以为是non-monetary liability,所以我是这样算: cash 210 + AR 300 - AP 270 = exposure 240

问题2

如下图,老师在课堂上讲到temporal method下计算translation exposure的公式其实是省略了non-monetary asset measured at current value;那麽考试时也不需要考虑non-monetary asset measured at current value,直接使用monetary asset - monetary liability = exposure来计算,对吗?