NO.PZ201602060100002005

问题如下:

5. The cash-flow-based accruals ratios from 2007 to 2009 indicate:

选项:

A.

improving earnings quality.

B.

deteriorating earnings quality.

C.

no change in earnings quality.

解释:

A is correct.

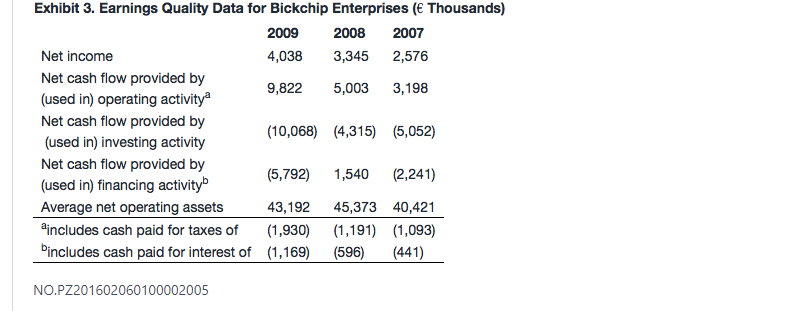

The cash-flow-based accruals ratio falls from 11.0 percent in 2007 to 5.9 percent in 2008, and then rises to 9.9 percent in 2009. However, the change over the three-year period is a net modest decline, indicating a slight improvement in earnings quality.

解析:cash-flow-based accruals ratio 2007的11%,变为2008年5.9%,到2009年的9.9%,总体趋势是在变低,accrual ratio越小说明earning质量越高。

这题没给NOA BEG, NOA END,是用什么条件算出来的ratio?