Empire & Associates, an investment management firm, has been in operation since 1974. Empire utilizes a proprietary valuation model based on fundamental analysis to select individual stock and bonds, and also employs technical analysis to help identify market anomalies and momentum effects. They use the output of their fundamental and technical analyses to actively manage clients’ accounts. Empire also recognizes the effects of investors’ background and past experiences on investors’ behaviors and decision making, and uses a behavioral alpha process to classify its clients into behavioral investor types.

Anthony Rodriguez, investment adviser, has been tasked with transitioning three new clients’ investment portfolios. Rodriguez has reviewed for each completed new client questionnaire, current portfolio, and some notes on the client. He prepares the following summaries:

Christine Blake is a 35-year old free-lance writer of several successful children’s books. Her primary source of income is royalty payments. She has accumulated a portfolio with a current value of $3.6 million. Blake has always self-managed the portfolio and has confidence in her investment abilities. Blake would like to be able to make independent decisions when opportunities arise. On several occasions, Blake has found herself holding positions with sizable losses and she has been reluctant to sell when a security declines. Because of these losses and the general size of her portfolio, she is seeking professional help. She is willing to consider higher risk investments if her research identifies an attractive opportunity. Her current portfolio consists of 15 equity positions of equal dollar value, diversified across eight industries and four different countries.

Margaret Neilson is a 59-year-old senior vice president of marketing for a highly successful, plastic injection corporation. Neilson has little investment experience and currently holds an $800,000 investment portfolio. Neilson has come to Empire because 80% of her portfolio is invested in the plastic injection corporation’s shares that were obtained through an employee stock ownership plan. Neilson is nearing retirement and is worried about a weakening economy and the potential effect it could have on the plastic injection corporation’s share price. Neilson wishes to avoid high risk situations.

Thomas Williamson is a 47-year-old surgeon; he is considered one of the world’s best in his specialty, and earns several million dollars each year. Williamson recognizes that he has limited investment expertise and considers himself a low to moderate risk taker. Williamson established a brokerage account several years ago and funded it with $4 million. He has made no withdrawals from and no additional payments into the account. He selected investments by acting on the advice of other doctors and friends. This advice led him to purchase many popular stocks, and his portfolio is currently worth $3.55 million. Because he was so busy, he felt he mistimed buying and selling stocks. His current portfolio is concentrated in shares of eight US healthcare companies.

Rodriguez is meeting with Ian Carter, portfolio manager and Lila Suzuki, investment strategist, later in the week to establish an investment plan for each client. Rodriguez has worked with Carter and Suzuki on other client accounts. To facilitate discussion at the meeting, Rodriguez has emailed the summary on each client and asked that they provide some preliminary views prior to the meeting.

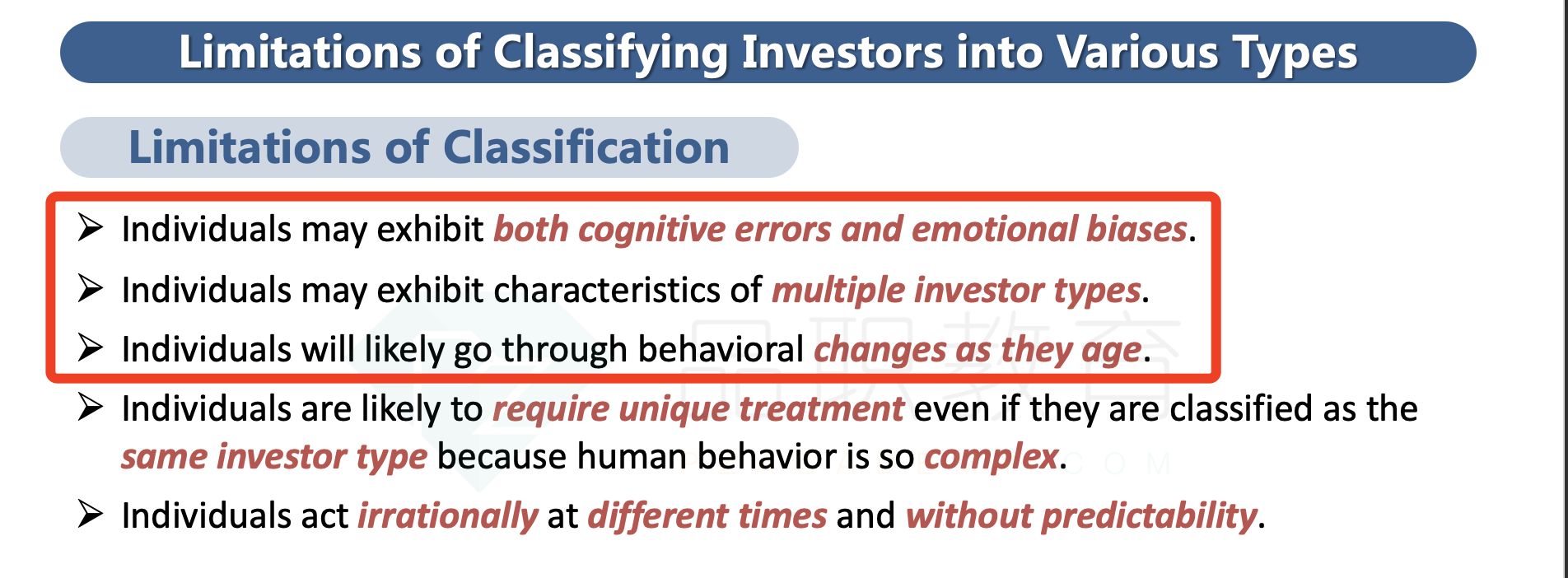

Carter is a senior portfolio manager with an excellent performance record. He has expressed concern about the use of investor type classification models due to their many limitations. Carter believes that Empire’s fundamental approach to analysis provides great value. However, he believes the technical analysis department is compatible with sound investment practices.

Suzuki tends to rigidly adhere to asset selections based on the proprietary valuation model. She has stated, “Sure it’s a complex model, but it incorporates hundreds of different pieces of data relevant to a company; therefore, it’s more thorough than any other analysis.” With respect to Empire’s technical analysis, Suzuki believes that the identified opportunities are not ‘true’ market anomalies but rather they are associated with higher risk exposures.

In establishing the portfolios for these new accounts, Rodriguez would like to address a recent memo from the technical analysis department that recommended overweighting clients’ portfolios in the technology and consumer goods sectors. The memo’s conclusion stated, “These sectors are depressed below their ten-year average levels. Every time that this has occurred in the past, these sectors have recovered to their mean in a short period of time.” Rodriguez believes that technical analysis has the potential to uncover opportunities where there are over- or under-reactions to relevant information.

(1)Carter’s statement regarding behavioral classifications is most likely justified because individual investors generally:

A exhibit characteristics of multiple investor types.

B retain the same emotional biases as they become older.

C exhibit primarily emotional or cognitive biases, but not both.

答案A

这个题目没明白为什么选择A?他对于客户的分类怎么了?