NO.PZ2018122701000062

问题如下:

Given the following bond portfolios:

Which of the following statements is correct?

选项:

A. Portfolio 1 is a barbell portfolio.

B. Portfolio 2 is a bullet portfolio.

C. It is impossible for Portfolios 1 and 2 to

have the same duration.

D. Portfolio 2 will have greater convexity than

Portfolio 1.

解释:

D is correct.

考点Measures of Pricing Sensitivity Based on Parallel Yield Shifts

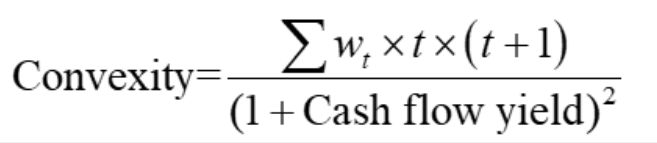

解析Since Portfolio 2 has more long-term bonds than short-term bonds and since convexity is related to the square of maturity, Portfolio 2 will have greater convexity. The other statements are incorrect. Portfolio 1 is a bullet portfolio (concentrated in intermediate maturities), and Portfolio 2 is a barbell. It is possible for a bullet and a barbell to have the same duration. In fact, adding the duration contribution of both portfolios gives a duration value of 8.15.

如题 D选项中的convexity怎么算