NO.PZ2020033003000107

问题如下:

Which of the following statements least accurately describe counterparty risk and lending risk?

选项:

A.For an interest-rate swap, there is no counterparty risk at the end of the contract term because all payments required by the contract would have been made by then.B.

With counterparty risk, there is uncertainty as to which counterparty will have a negative mark-to-market value.

C.Counterparty risk is typically bilateral while lending risk is typically unilateral.

D.

With lending risk, the principal amount at risk is known with absolute certainty at the outset.

解释:

D is correct.

考点: Counterparty risk and lending risk

解析:

The principal amount at risk is known only with reasonable certainty at the outset because changes in interest rates, for example, will lead to some uncertainty.

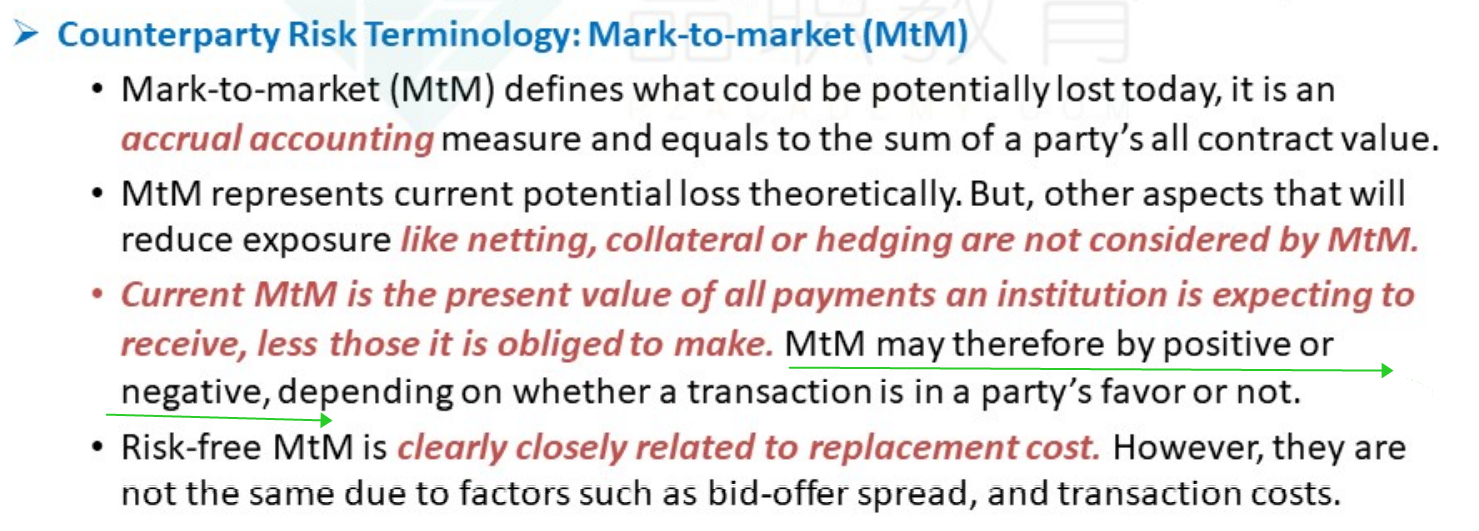

B选项为什么是对的? 有counterparty risk 的一方不是应有positive MtM value吗?