NO.PZ2020033002000046

问题如下:

Which of the following trade would suffer credit loss if the counterparty defaults before maturity?

选项:

A.Shorting euro/USD forward FX contract, and the euro has appreciated.

B.Shorting euro/USD forward FX contract, and the euro has depreciated.

C.Selling a OTC euro call option, and the euro has appreciated.

D.Selling a OTC euro call option, and the euro has depreciated.

解释:

B is correct.

考点:Credit exposure

解析:

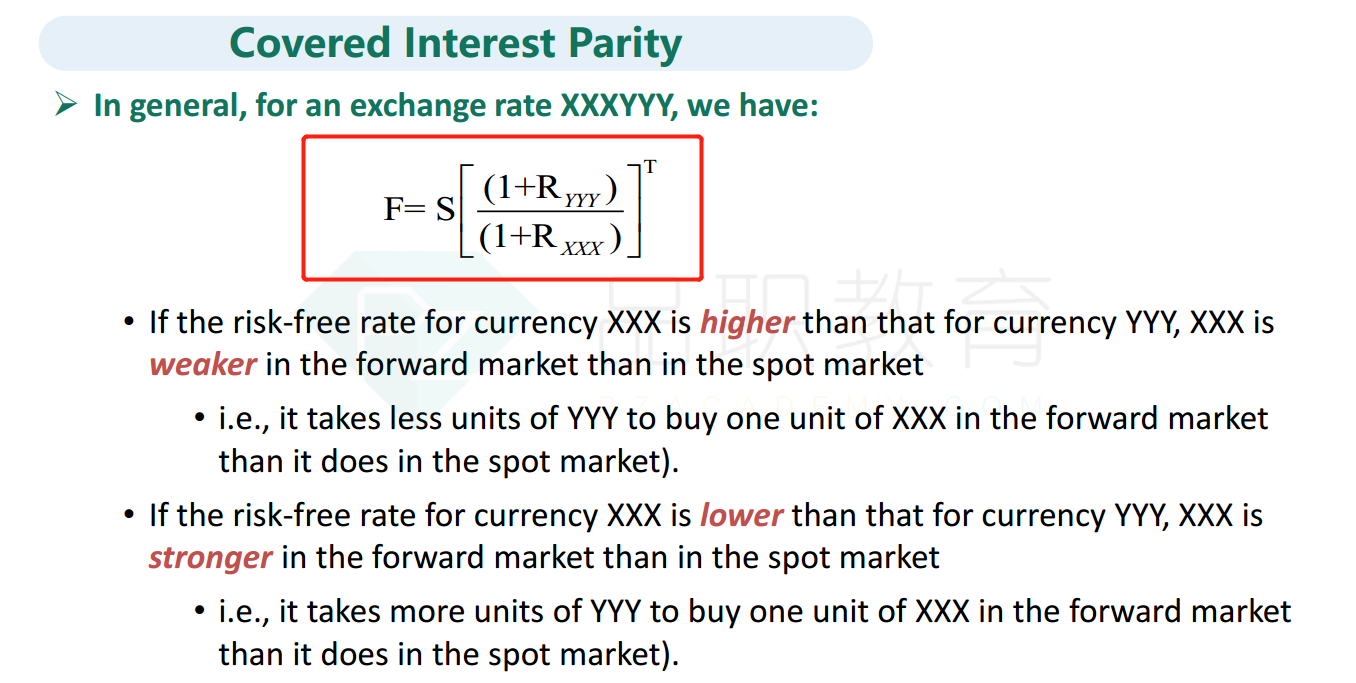

做空欧元,则当欧元下跌时获利,此时如果对手方违约,就会产生损失。

卖出期权没有信用风险敞口,所以不选C D

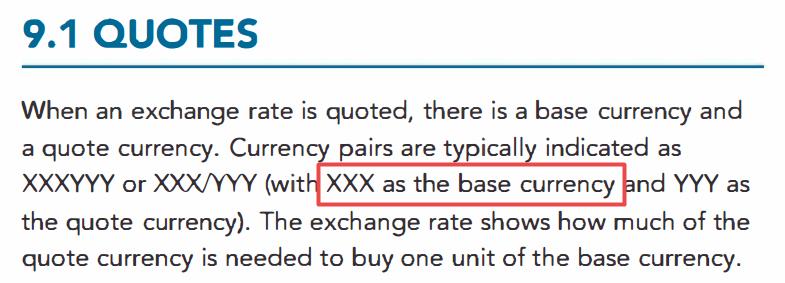

就像楼上老师的截图 EUR/USD 怎么能是多少美元来买1欧元呢0.0

1.1 EUR/USD 不应该是1 USD = 1.1 EUR的意思吗(也就是多少欧元来买一美元呀) 我不理解0.0

这是什么特殊语境的特殊用法吗~ 困惑了

【如果short EUR/USD是做空欧元 这道题我知道B是对的 但是对这个“short EUR/USD是做空欧元” 我不理解-。-