NO.PZ2018111302000022

问题如下:

Based on below information, what is the value of the Property using the discounted cash flow method, assuming a three-year holding period? And the Property is expected to have the same net operating income for the holding period due to existing leases, and a one-time 20% increase in year 4 due to lease rollovers. No further growth is assumed thereafter.

选项:

A.£3,354,418.

B.£3,860,883.

C.£4,620,580.

解释:

B is correct.

考点:现金流折现法估计房地产价值

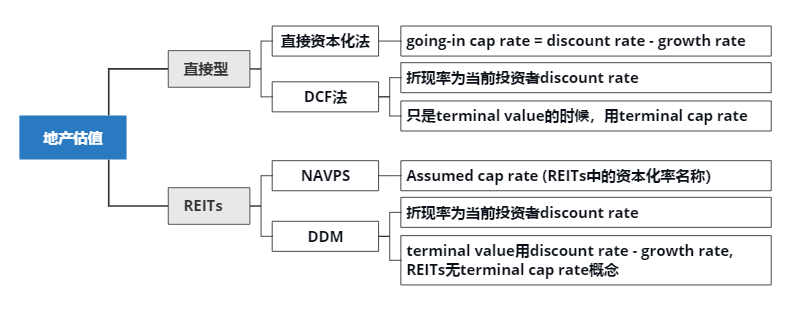

解析:可以按照以下思路进行计算,注意计算terminal value需要使用terminal cap rate, 而不是going-in cap rate.

Step 1: 计算NOI

net operating income (NOI) = rental income + other income – vacancy and collection loss – property management costs

NOI = £500,000 + £85,000 – £48,000 – £32,000 – £186,000= £319,000

Step 2: DCF model

或者这里也可以直接用计算器CF计算,I/Y=8%, N = 3, FV = £319,000*(1+20%)/10%=3,828,000, PMT = £319,000, => CPT PV = 3,860,884

李老师不是说TV英爱用terminal cap rate (10%)折现吗?