问题如下:

Based upon the following statements,which of the following is most accurate with regard to the company’s solvency?

选项:

A.Based on the return on equity,the company’s solvency is deteriorating.

B.Based on the debt-to-equity ratio,the company’s solvency is deteriorating.

C.Based on the debt-to-equity ratio,the company’s solvency is improving.

解释:

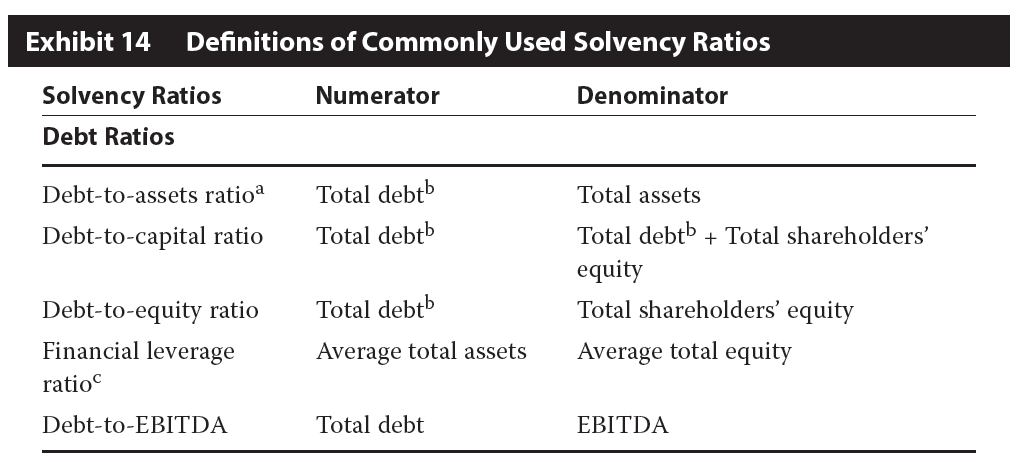

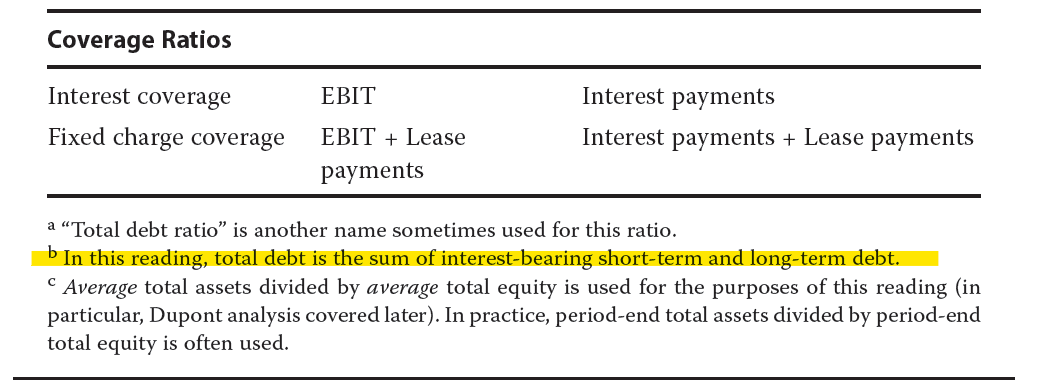

C is correct.Its debt-to-equity ratio is 200/100=2 for 2016 and 25/325=0.077 for 2017,indicating the company’s solvency is improving.

- D/E ratio 的 E 永远是 Total Asset - Total Liability 么?有没有什么时候是只看一部分 E,比如只看 contributed capital 一开始出资人的 E?

- 这里的 D/E 计算中, total debt 不把 current liability 加进去的原因是什么?是不是因为这个 Leverage 是考察长期偿债能力,所以只看长期负债?

- 如果我要计算 ROE,你看看我算的对不对,我的想法是把总的付的利息net interest payable去掉交给税务局的taxation部分,剩下的就是应该给债务人的部分

- 2016: [57+(18-5)]/ 100 = 6

- 2017:[132+(54-19)]/ 100 = 6

问题 2 中

基础班讲义

强化班讲义不一样

强化班是只有 D,基础班说是 Total D