问题如下:

Tim, an investment analyst in a securities firm, is preparing a monthly report for his clients. The aim of this report is to tell his clients the methods he uses to make investment decisions and the performance of the portfolio for the past month. Tim made the following statements in the methods part:

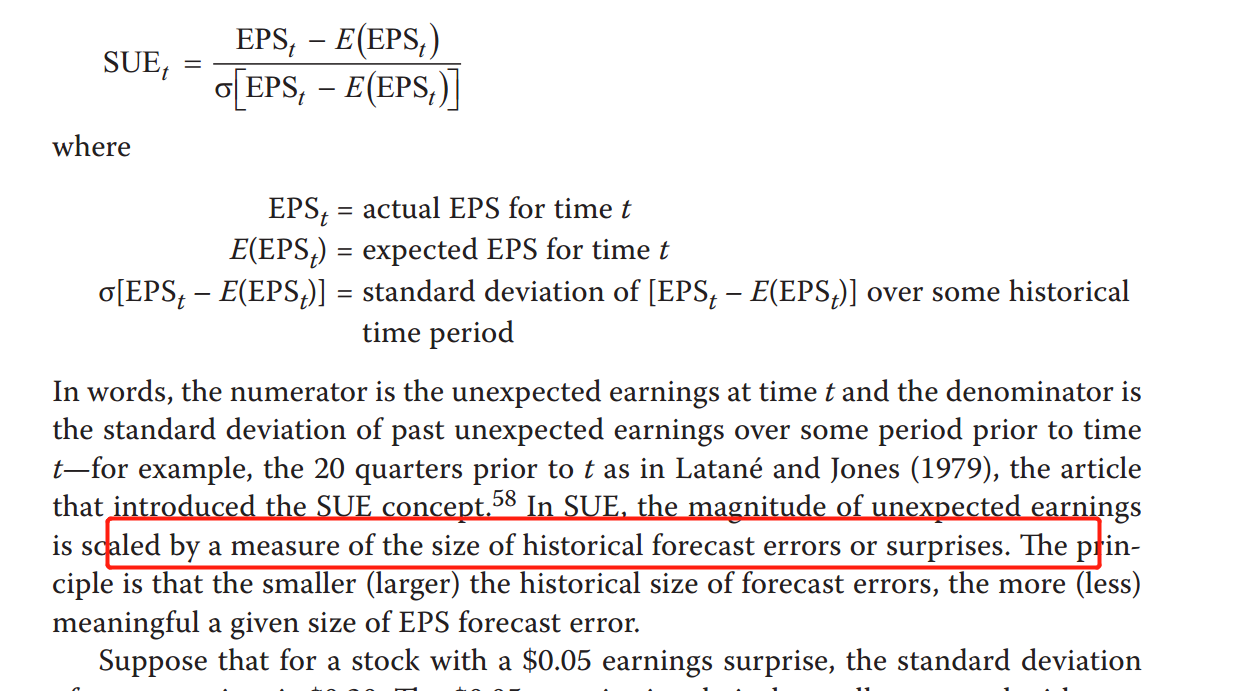

Statement 1: Compared with the unexpected earnings, the SUE standardises the unexpected earnings by the standard deviation of historical forecast errors or surprises.

Statement 2: Relative-Strength indicators compare a stock’s performance during a certain period with its past performance or compare its certain period’s performance with the performance of some group of stocks.

According to the information above, which of the following is correct?

选项:

A.Statement 1 is correct, but statement 2 is wrong.

B.Statement 1 is wrong, but statement 2 is correct.

C.Both of statements are correct.

解释:

C is correct.

考点:考察Standardised unexpected earnings、unexpected earnings,以及Relative-strength indicators的理解。

解析:关于UE,以及SUE有以下公式:

即本期的Unexpected earnings等于本期实际的earnings减去本期预期的Earnings.

而关于SUE有如下公式:

其中分子是Unexpected earnings,分母为历史unexpected earnings的标准差。

不是很理解题目里1的意思,为啥涉及historcial error ?