问题如下:

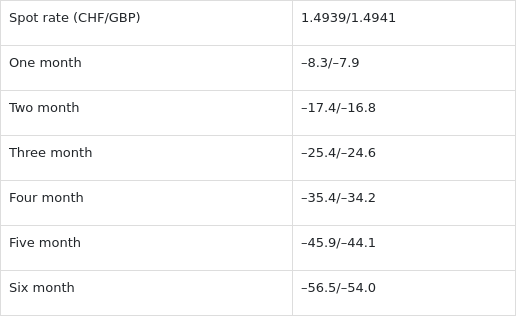

The following are the current spot rate and forward

points being quoted for theCHF/GBP currency pair:

The current all-in

bid rate for delivery of GBP against the CHF in three months isclosest to:

选项:

A. 1.49136

1.49150

1.49164

解释:

The

current all-in three month bid rate for GBP (the base currency) is equalto

1.4939 + (–25.4/10,000) = 1.49136.

解析:根据表格数据,计算过程如下:

1.4939

+ (–25.4/10,000) = 1.49136.

这道题目的A选项跑偏了,看着很不舒服~麻烦抽空调整一下