NO.PZ2023101902000034

问题如下:

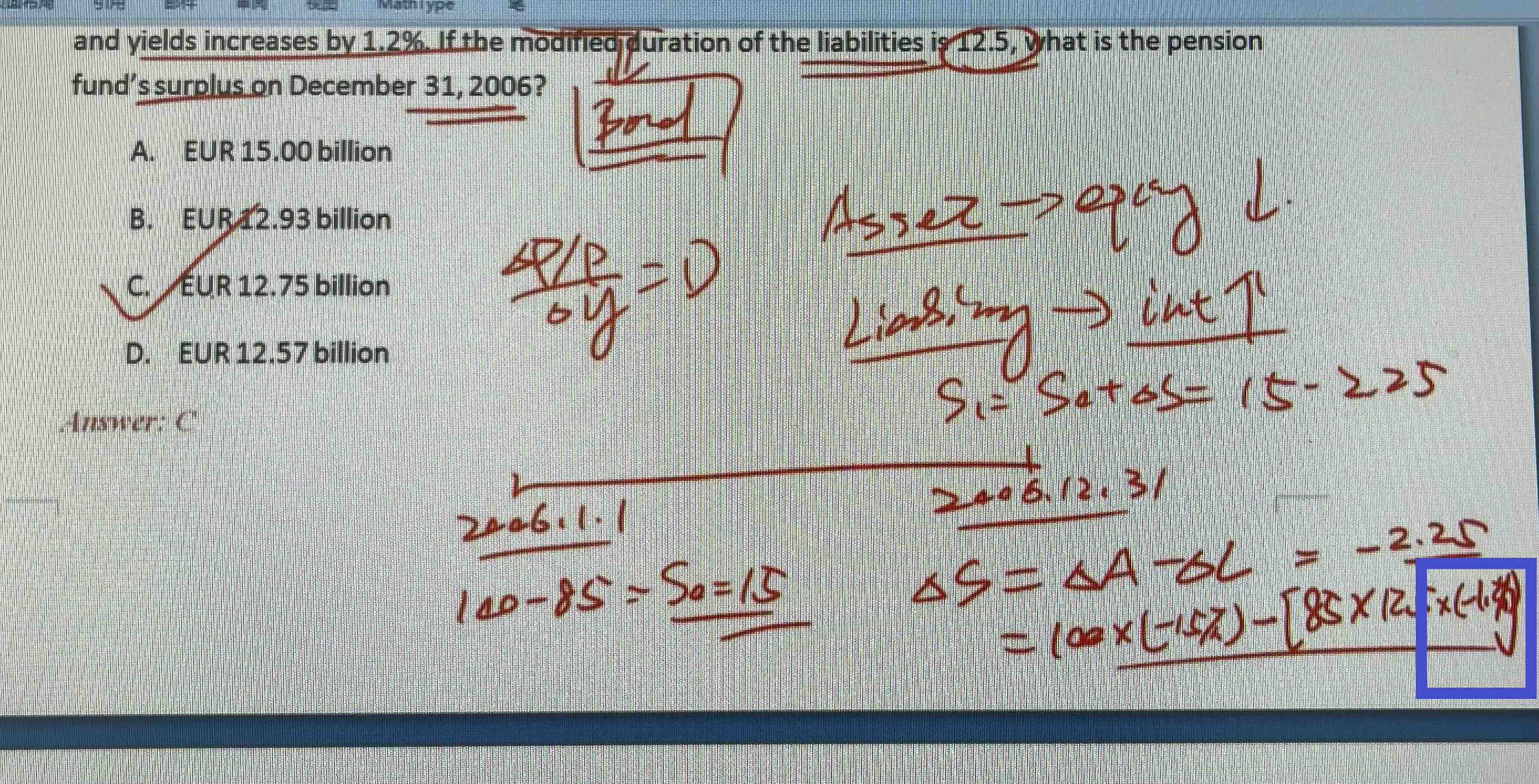

On January 1, 2006, a pension fund has assets of EUR 100 billion and is fully invested in the equity market. It has EUR 85 billion in liabilities. During 2006, the equity market declined by 15% and yields increases by 1.2%. If the modified duration of the liabilities is 12.5, what is the pension fund’s surplus on December 31, 2006?

选项:

A.EUR 15.00 billion

B.EUR 12.93 billion

C.EUR 12.75 billion

D.EUR 12.57 billion

解释:

The surplus at the beginning of the year was 100 – 85 = 15 billion EUR. During the year, the equity portfolio declines 15%, or 15 billion EUR, to 85 billion EUR. Due to the increase in yields, the dollar value of the liabilities decrease by 12.5 × 1.2% × 85 billion EUR, or 12.75. Thus at the end of the year, the assets are worth (100-15)=85billion EUR and the liabilities (85 - 12.75) = 72.25 billion. The surplus is the 12.75, a decrease of 2.25 billion EUR.

老师,这里是不是讲错了?负号应该跟着duration吧?而不是利率是-1.2%,因为利率明明是increase