NO.PZ2023010903000020

问题如下:

The Cherry Street Foundation is a nonprofit institution who has experienced a significant increase in donations over the last several years. Consequently, Ellie Blumenstock, CFA, Cherry Street's founder, recently concluded that the time had come to hire a professional chief investment officer(CIO) to manage this large pool of assets. Today, Blumenstock is interviewing A.J. Gelormini,a portfolio manager with over two decades of experience, for the CIO role.

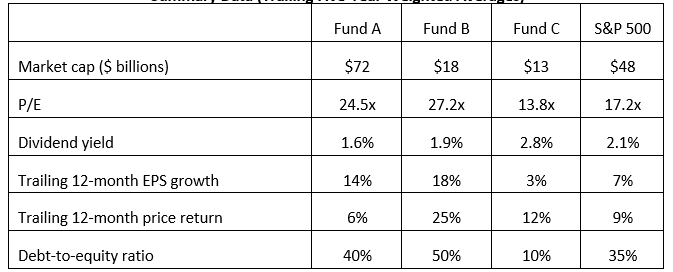

Gelormini responds by suggesting that Cherry Street invest in a handful of factor-based strategies that track the S&P 500. He states that these strategies have the potential to improve returns while limiting tracking error versus the benchmark. He then presents Blumenstock with a one-page comparison of several such funds, a summary of which is provided in Exhibit 1. Note that the values provided in Exhibit 1 represent the average quarterly values for each of the underlying holdings in Fund A, Fund B, Fund C and each of the constituents in the S&P 500, calculated on a trailing five-year basis. All data on the underlying holdings and index constituents is sourced from their SEC filings and publicly available market data.

Exhibit 1

Factor-Based Funds

Summary Data (Trailing Five-Year Weighted Averages)

选项:

A.

Fund A

B.

Fund B

C.

Fund C

解释:

Given the information provided, the potential factors we can assess are size(market cap), value(P/E), yield(dividend yield), growth(EPS growth), momentum(price return) and quality(debt-to-equity ratio).

A small relative market cap, low relative P/E and low relative debt-to-equity ratio suggest that Fund C focuses on the size, value and quality factors.

A high relative P/E and EPS growth suggests that Fund A focuses on the growth factor. Fund A does not appear to have exposure to the size, yield, momentum or quality factors.

A high relative P/E and EPS growth, small relative market cap and high trailing twelve-month price return suggest that Fund B focuses on the size, growth and momentum factors.

如题,size因子和price momentum因子应该如何分析? 虽然表格列出了各个fund的市值规模大小,但不能说fund A是market cap大,就是投资了大盘股吧?这个fund的AUM很大,但投资的都是小盘股,这样不行吗? 另外,关于价格动量因子的分析毫无头绪,希望老师解答一下