NO.PZ201709270100000304

问题如下:

4. Based on Exhibit 1, the predicted ROE for DF Associates is closest to:

选项: 10.957%.

16.593%.

C.20.388%.

解释:

C is correct. The regression equation is as follows:

请问怎么知道X1是55;X2是10.5?

题目中的DF是什么意思?

Ivana 🍭 · 2024年01月08日

* 问题详情,请 查看题干

NO.PZ201709270100000304

问题如下:

4. Based on Exhibit 1, the predicted ROE for DF Associates is closest to:

选项: 10.957%.

16.593%.

C.20.388%.

解释:

C is correct. The regression equation is as follows:

请问怎么知道X1是55;X2是10.5?

题目中的DF是什么意思?

已明白。

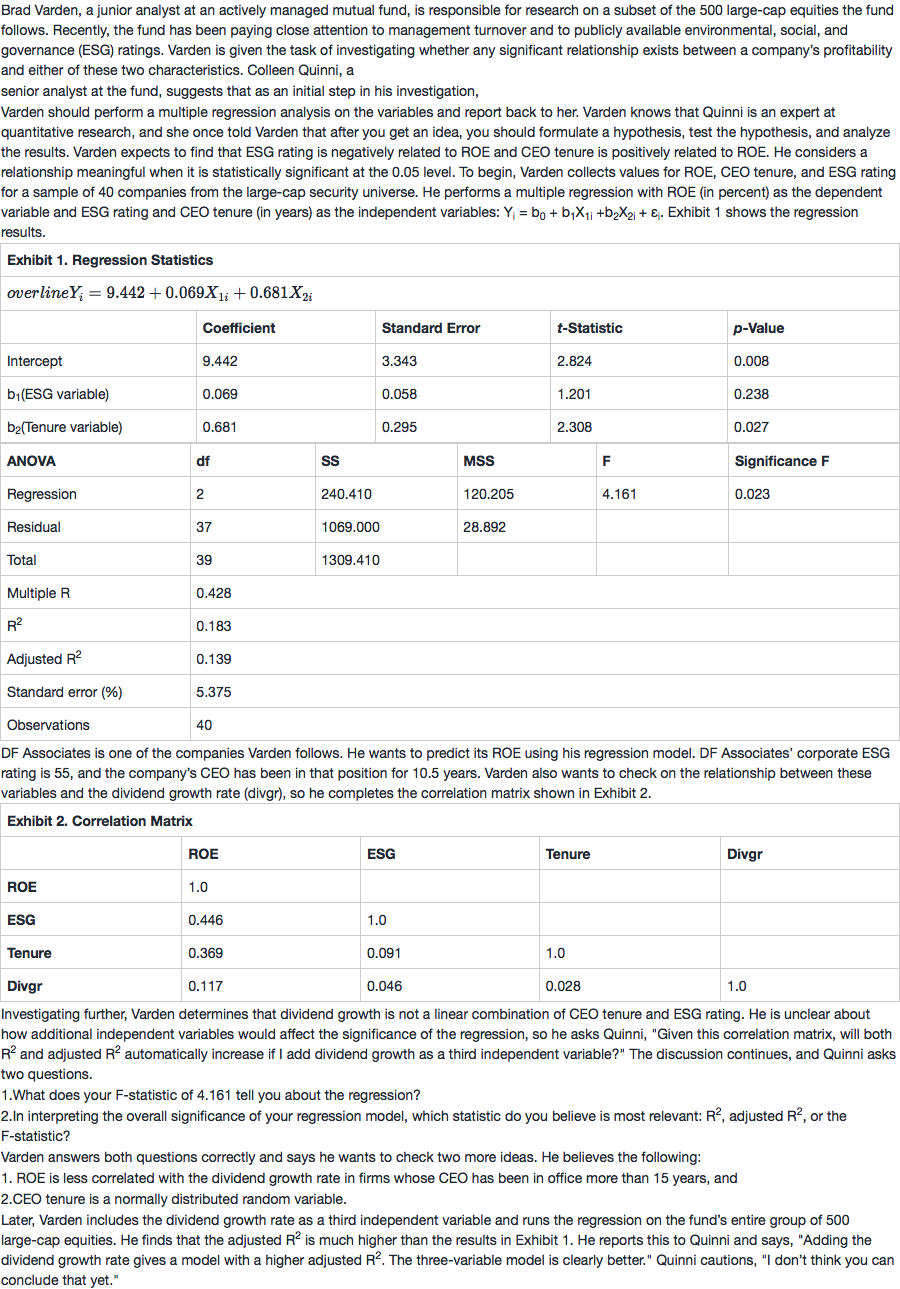

NO.PZ201709270100000304问题如下 4. Baseon Exhibit 1, the precteROE for Associates is closest to: 10.957%. 16.593%. 20.388%. C is correct. The regression equation is follows:beginarraylY∧i=9.442+0.069X1i+0.681X2iROE=9.442+0.069(ESG)+0.681(Tenure)=9.442+0.069(55)+0.681(10.5)=9.442+3.795+7.151=20.388begin{array}{l}{\overset\wee Y}_i=9.442+0.069X_{1i}+0.681X_{2i}\\ROE=9.442+0.069(ESG)+0.681(Tenure)\\=9.442+0.069(55)+0.681(10.5)\\=9.442+3.795+7.151=20.388beginarraylY∧i=9.442+0.069X1i+0.681X2iROE=9.442+0.069(ESG)+0.681(Tenure)=9.442+0.069(55)+0.681(10.5)=9.442+3.795+7.151=20.388 题目原文里面说的这句话Varn expects to finthESG rating is negatively relateto ROE anCEO tenure is positively relateto ROE.但是为何公式里面的b1是大于0的呢?

4. Baseon Exhibit 1, the precteROE for Associates is closest to: 10.957%. 16.593%. 20.388%. C is correct. The regression equation is follows: beginarraylY∧i=9.442+0.069X1i+0.681X2iROE=9.442+0.069(ESG)+0.681(Tenure)=9.442+0.069(55)+0.681(10.5)=9.442+3.795+7.151=20.388begin{array}{l}{\overset\wee Y}_i=9.442+0.069X_{1i}+0.681X_{2i}\\ROE=9.442+0.069(ESG)+0.681(Tenure)\\=9.442+0.069(55)+0.681(10.5)\\=9.442+3.795+7.151=20.388beginarraylY∧i=9.442+0.069X1i+0.681X2iROE=9.442+0.069(ESG)+0.681(Tenure)=9.442+0.069(55)+0.681(10.5)=9.442+3.795+7.151=20.388 题目中显示是0.0681,而答案写的是0.681

4. Baseon Exhibit 1, the precteROE for Associates is closest to: 10.957%. 16.593%. 20.388%. C is correct. The regression equation is follows: beginarraylY∧i=9.442+0.069X1i+0.681X2iROE=9.442+0.069(ESG)+0.681(Tenure)=9.442+0.069(55)+0.681(10.5)=9.442+3.795+7.151=20.388begin{array}{l}{\overset\wee Y}_i=9.442+0.069X_{1i}+0.681X_{2i}\\ROE=9.442+0.069(ESG)+0.681(Tenure)\\=9.442+0.069(55)+0.681(10.5)\\=9.442+3.795+7.151=20.388beginarraylY∧i=9.442+0.069X1i+0.681X2iROE=9.442+0.069(ESG)+0.681(Tenure)=9.442+0.069(55)+0.681(10.5)=9.442+3.795+7.151=20.388 怎么算的,我算的答案时13.9521啊。答案里没显示计算过程

如果某一项的系数不significant的话,还需要算它吗?