NO.PZ201601200500005003

问题如下:

Based on Exhibit 1, if Yeta’s management implemented Proposal #3 at the current share price, earnings per share would:

选项:

A.decrease

remain unchanged

increase

解释:

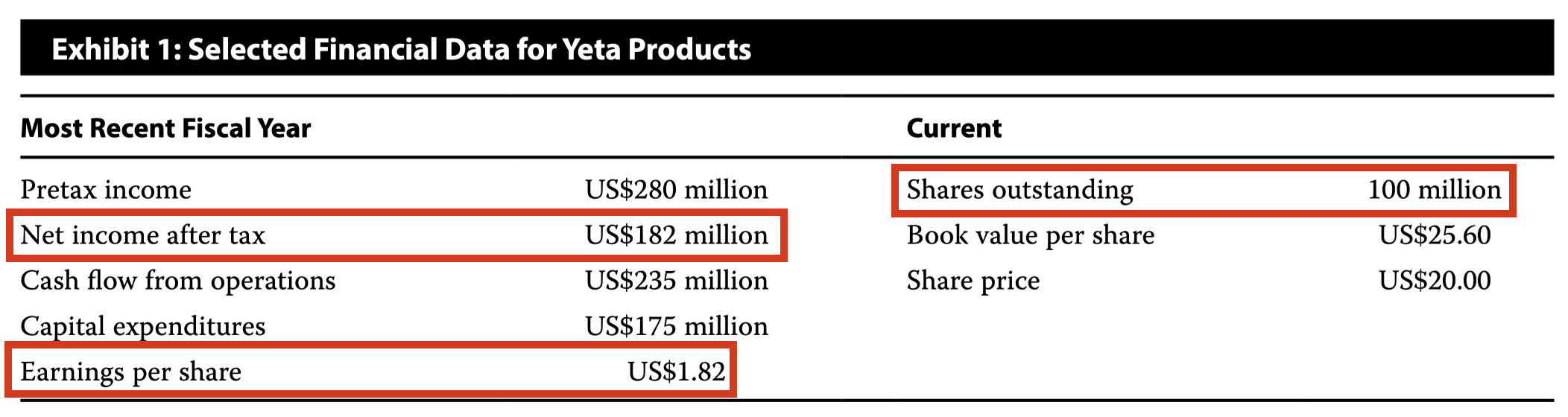

C is correct. In the case of external funding, a company’s earnings per share will increase if the stock’s earnings yield, which is the ratio of earnings per share to share price, exceeds the after-tax cost of borrowing. Yeta’s earnings yield is 9.10% (= US$1.82/US$20.00), which exceeds the after-tax cost of borrowing of 8.50%.

A is incorrect because EPS will increase (not decrease) if the stock’s earnings yield (= US$1.82/US$20.00) exceeds the after-tax cost of borrowing. Yeta’s earnings yield of 9.10% exceeds the after-tax cost of borrowing of 8.50%.

B is incorrect because EPS will increase (not remain unchanged) if the stock’s earnings yield (= US$1.82/US$20.00) exceeds the after-tax cost of borrowing. Yeta’s earnings yield of 9.10% exceeds the after-tax cost of borrowing of 8.50%.

本题题干中,Eps为什么是1.82呢?给到了NI,和股数,算出来你不是1.82?是什么原因引起的呢?