NO.PZ201601050100001401

问题如下:

Identify the most likely approach for Lee to optimally locate Wilson’s portfolio

on the currency risk spectrum, consistent with the IPS. Justify your response

with two reasons supporting the approach.

选项:

解释:

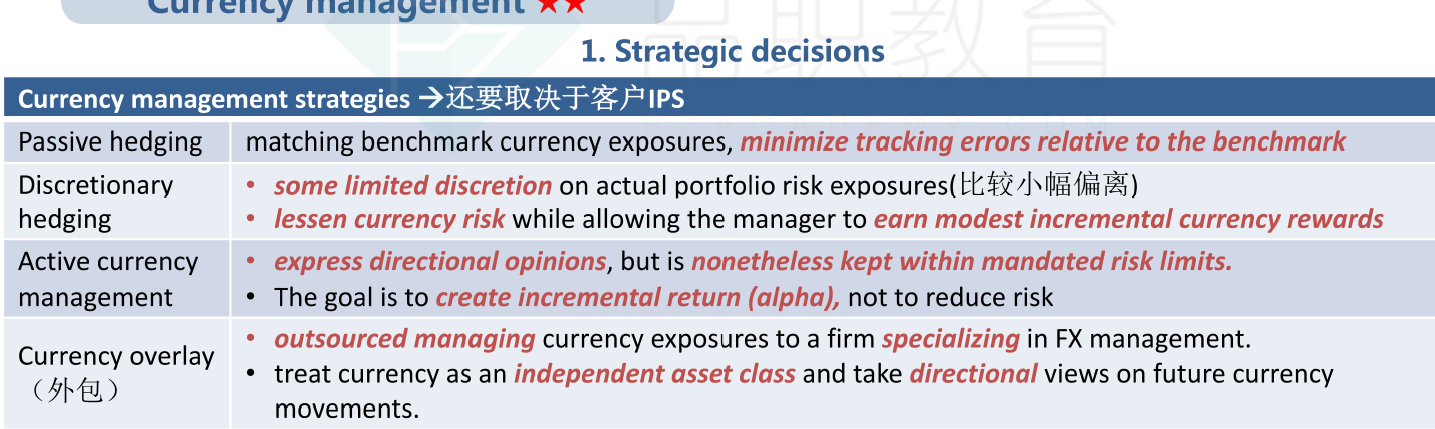

Passive hedging is not likely because the IPS allows the 3% band around the

neutral position. In addition, passive hedging is a rules-based approach, which

is contrary to Wilson’s preference.

Active currency management is not likely because the 3% band around the

neutral position is too limited for that approach. In many cases, the difference

between discretionary hedging and active currency management is more of

emphasis than degree. The primary duty of the discretionary hedger is to protect the portfolio from currency risk. Active currency management is supposed

to take currency risks and manage them for profit. Leaving actual portfolio

exposures near zero for extended periods is typically not a viable option.

Currency overlay is not likely because the 3% band is too small to indicate

active currency management in a currency overlay program. In addition,

currency overlay programs are often conducted by external, FX-specialized sub-advisers to a portfolio, whereas Lee is a generalist managing a variety of portfolios across asset classes. Finally, currency overlay allows for taking directional

views on future currency movements, and a lack of market conviction is noted

here.

中文解析:

IPS允许有相比于中性头寸上下3%的波动幅度,因此不是被动管理的方法。

不是主动管理的方法,因为3%的波动区间对于这种方法来说太有限了。在许多情况下,可自由决定的对冲方法和主动管理的方法之间的区别更多的是重点而不是程度。

可自由决定的套期保值者的主要职责是保护投资组合免受货币风险的影响。

而主动管理应该是承担货币风险,并以盈利为目的进行管理,因此将实际投资组合的风险敞口长期保持在接近于零的水平,通常不是一个可行的选择。

不是currency overlay的方法,因为在货币覆盖程序中,3%的幅度太小,不足以表示积极的货币管理。此外,货币覆盖程序通常是由外部的、外汇专业的投资组合次级顾问进行的,而Lee是一个多面手,管理各种资产类别的各种投资组合。最后,currency overlay允许对未来货币走势采取方向性看法,这里指出缺乏市场信念。

Wilson prefers a neutral benchmark over a rules- based approach, with its investment policy statement (IPS) requiring a currency hedge ratio between 97% and 103% to protect against currency risk.

这个怎么排除passive Hedging,毕竟这个只是有浮动,仍然可以100%hedging。